Optimum Business Decisioning with Perpetual ML Suite

In the domain of quantitative decision-making, the transition from predictive modeling to prescriptive action is critical. For high-stakes problems, model accuracy must be effectively translated into maximum expected utility or objective fulfillment. This necessitates a comparison between standard modeling pipelines, such as a Calibrated LightGBM, and integrated systems like Perpetual ML Suite's PerpetualBooster + Optimum Business Decisioning.

Note: This analysis uses the publicly available TVS_Loan_Default dataset from OpenML (Data ID: 43743) for benchmarking purposes.

The utility of a machine learning model is determined not merely by its predictive metrics (e.g., AUC or F1-score) but by its capacity to inform an optimal binary action (e.g., approve or reject). This process requires the determination of a precise decision threshold to convert a probability score (e.g., P(Negative Outcome)) into a definitive course of action. The optimal threshold isn't just about minimizing errors; it's about maximizing the prescribed objective.

The Financial Decision Framework: Bridging Prediction and Utility

To operationalize this utility, we define a clear business objective function based on key financial parameters. This function rigorously calculates the expected profit contingent upon the true outcomes (ytrue) and the predicted probabilities (ypred) across a range of potential thresholds.

def business_objective(y_true, y_pred, threshold) -> float:

interest_rate = 0.12

# Select loans where predicted probability is below the threshold (approved)

loan_status = y_true[y_pred < threshold]

ead = 10000 # Exposure at Default

capital = ead * len(loan_status) # Total capital for normalization

revenue = len(loan_status) * ead * interest_rate

cost_rate = 0.045 # Cost percentage of EAD for each approved loan

cost = len(loan_status) * ead * cost_rate

lgd = 0.7 # Loss Given Default

loss = np.sum(loan_status) * ead * lgd

profit = revenue - cost - loss

margin = (profit / capital) * 100 # Normalize by total exposure

return profit, marginThis utility function incorporates essential financial components for the specific case study: Interest Rate (0.12), Exposure at Default (EAD) ($10,000), Cost Rate (0.045), and Loss Given Default (LGD) (0.7).

Probability Calibration: The Baseline Approach

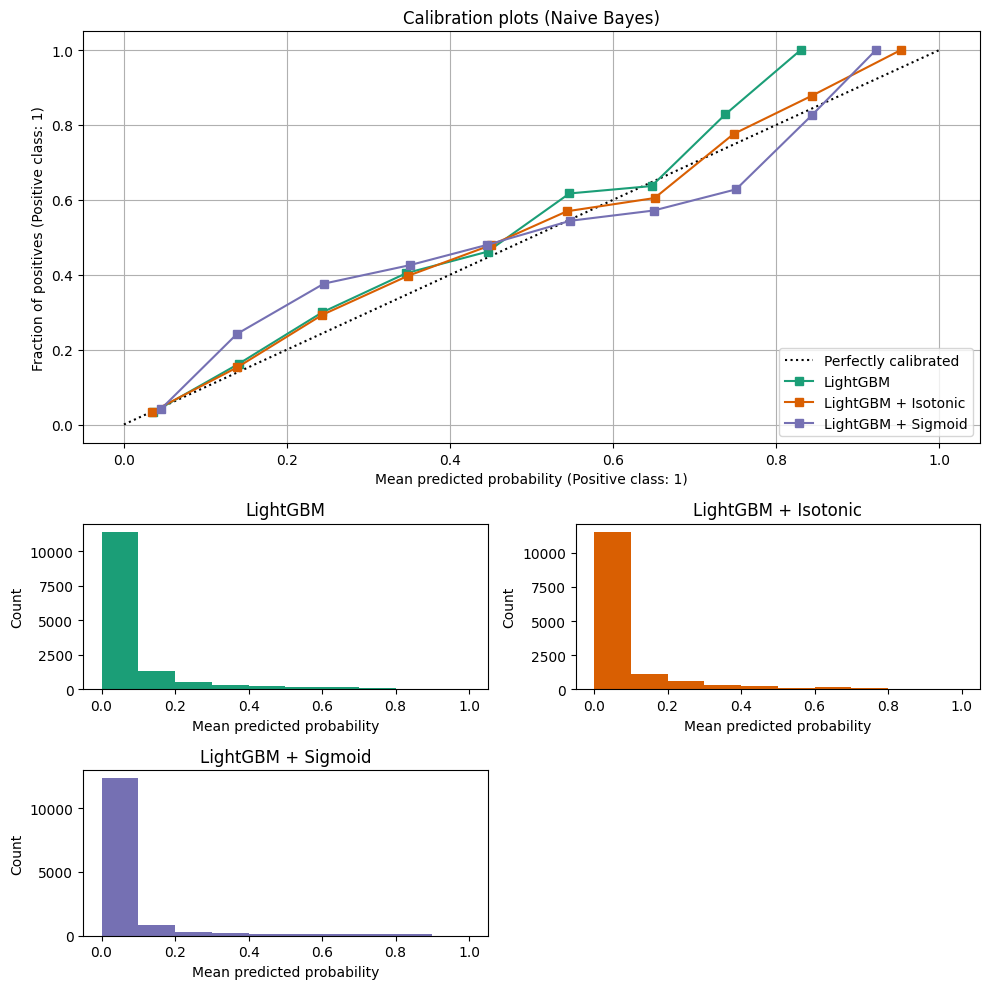

A standard, high-performance baseline involves not just training a model like LightGBM, but also calibrating its output. Prior to threshold optimization, the integrity of the predicted probabilities must be validated. A prediction of 0.10 must strictly correspond to a 10% likelihood of default. While LightGBM provides superior discrimination, its native probability estimates often suffer from poor calibration.

For our baseline, we employed scikit-learn's CalibratedClassifierCV for model refinement, utilizing Isotonic and Sigmoid post-processing methods to enhance the reliability

of probability estimation.

| Model Variant | Expected Calibration Error (ECE) |

|---|---|

| Baseline LightGBM | 0.01021 |

| LightGBM + Isotonic | 0.00622 |

| LightGBM + Sigmoid | 0.01569 |

The LightGBM + Isotonic configuration demonstrated the lowest Expected Calibration Error (ECE) of 0.00622, establishing it as a trustworthy and robust baseline for subsequent profit optimization.

Empirical Results: A Comparative Analysis

We sought the decision threshold that globally maximizes the business objective function on an independent validation set for both the baseline and the Perpetual ML Suite.

Baseline: Calibrated LightGBM

The optimal threshold determined via conventional search methods on the Calibrated LightGBM model was 0.104. This yielded a maximum expected profit of $5,912,750 on the reserved test set.

Perpetual ML Suite: PerpetualBooster + Decisioning

In contrast, deploying the fully integrated PerpetualBooster model combined with Optimum Business Decisioning on the identical dataset produced a superior result: $5,988,250.

This performance differential represents a 1.3% increase in expected financial return over the highly optimized Calibrated LightGBM baseline.

Given the scale of global lending operations, a 1.3% improvement in the core decision mechanism translates directly into multi-million dollar enhancements in annual bottom-line performance.